AuctionGate | Account management - Calculation of import to EU countries

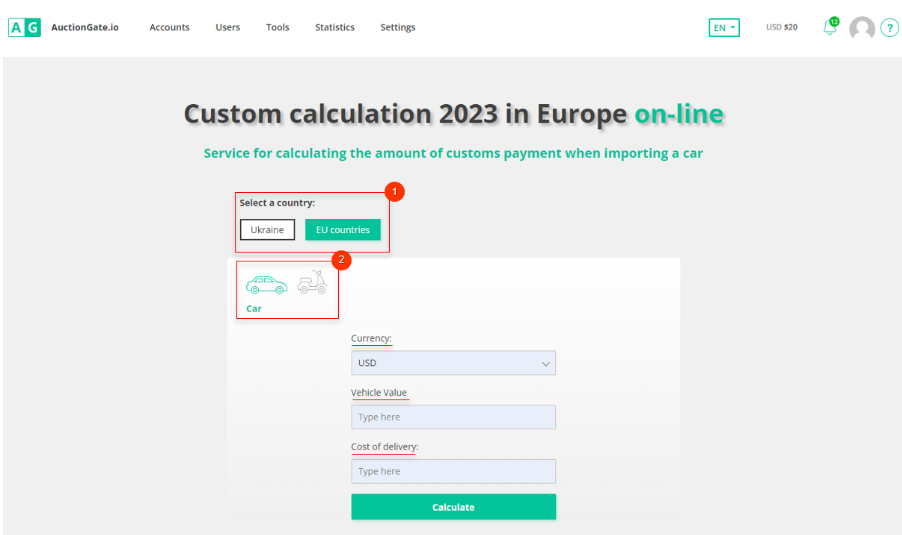

In order to calculate the customs payment when importing a vehicle to an EU country, click on the "EU Countries" button, then specify the vehicle type (Figure 1, Pointer 1/Pointer 2). Then enter the fields in the table:

-

"Currency" - from the drop-down list that opens when you click on the button

, select the currency for which the vehicle was purchased;

-

"Vehicle cost" - using keyboard input or by pressing the buttons

, enter the vehicle cost;

-

"Cost of delivery" - using keyboard input or by pressing the buttons

, enter the vehicle delivery cost.

To calculate the cost, click the "Calculate" button

Figure 1 - "Calculation of customs payment for imports to EU countries"

As a result, the table will display information and amounts calculated based on the entered data. The table consists of 2 blocks:

-

Data for Calculation;

-

Import payments.

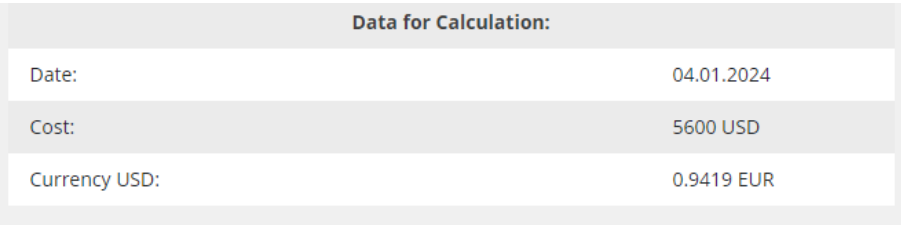

The "Data for Calculation" block includes information that was calculated based on the raw data (Figure 2), where:

-

"Date" - the day on which the calculation was made, this field is filled automatically with the current date;

-

"Cost" - includes an amount that consists of the cost of the vehicle and the cost of delivery;

-

"Currency USD" - shows the value of the selected currency relative to the Euro exchange rate.

Figure 2 - Block "Calculation data"

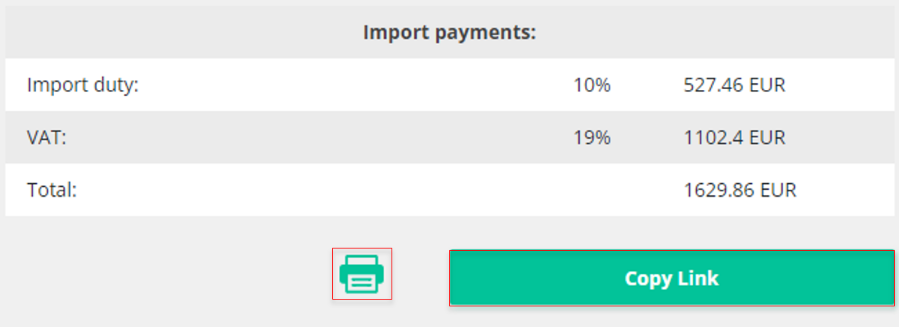

The "Import Payments" block contains information on customs payments (Figure 3), where:

-

"Import duty" - is a tax that is levied when a vehicle is imported from another country;

-

"VAT" - is a tax that is levied on the importation of vehicles into the EU. The VAT rate may vary depending on the type of vehicle and other factors, but typically the rate is between 17% and 27%.

-

"Total" - is the total amount of customs payments.

Figure 3 - Import payments block

After calculating the customs payments, click on the button to print this calculation. As a result, the document will be opened in a new browser window (Figure 4). If you want to copy the link of the customs payment calculation, click on the "Copy link" button.